AOL and Time Warner (Fortune's parent company) announced a $165 billion merger, promising to marry the best news and entertainment content with the distribution medium of the future, the Internet. To say it was a bad match is an exercise in understatement.

AOL and Time Warner (Fortune's parent company) announced a $165 billion merger, promising to marry the best news and entertainment content with the distribution medium of the future, the Internet. To say it was a bad match is an exercise in understatement. In 2002, AOL Time Warner posted the largest-ever U.S. corporate loss as it wrote off most of the value of the merger. The next year, the company bid adieu to the managers who created it and stripped AOL from the corporate letterhead.

This month, Time Warner and AOL finally parted ways, nine years later and more than $100 billion poorer. So much for the deal Ted Turner once gushed was better than sex.

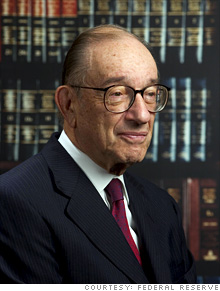

Just days after President George W. Bush took office, Fed chief Alan Greenspan admonished budgeteers about the dangers of -- get this -- too little federal debt.

Just days after President George W. Bush took office, Fed chief Alan Greenspan admonished budgeteers about the dangers of -- get this -- too little federal debt."At zero debt, the continuing unified budget surpluses currently projected imply a major accumulation of private assets by the federal government," Greenspan told the Senate Budget Committee.

As it turns out, the United States has been able to kick its nasty surplus habit, spilling at least $158 billion of red ink every year since Greenspan's testimony. Yet thanks to the financial sector debt crisis that precipitated bailouts such as TARP, the feds ended up accumulating huge amounts of private assets anyway. We've got 7.7 billion shares of Citigroup -- any takers?

NEXT: July 19, 2002: WorldCom's bankruptcy

No comments:

Post a Comment