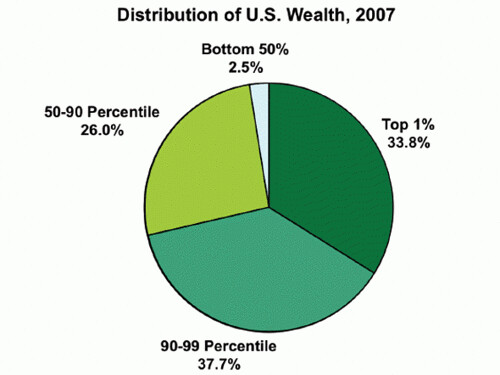

You and I pay income tax on our income. But if your income comes from having really, really wealthy parents you are entitled to really, really special treatment because that is how democracy plutocracy works.

In the news: Kyl: Deal on the estate tax in the offing,

Sources close to the matter told The Hill last week that lawmakers are looking to give taxpayers the option of prepaying their estate tax. The levy would be set at 35 percent for those worth more than $3.5 million, however the exemption would ultimately increase over time to $5 million and would not be indexed for inflation. Prepayment trusts would pay a lower rate.

And the first $3.5-5 million of income? Just not enough to bother with.

There's also a special "carried interest" tax break that lets plutocrats hedge fund managers pay only 15% on their income.

Still, taxing carried interest at normal income tax rates would be a major blow to managers of private equity, which is still struggling nearly three years after the financial crisis took away much of its cheap credit.

Lobbyists for the investment industry, particularly those representing private equity firms and hedge funds, have fought hard to keep carried interest from being taxed as ordinary income for years. Two measures introduced in Congress over the last three years to raise the tax rate on carried interest failed to gain traction in the Senate.

Click through this link to see what is meant by "still struggling."

http://ourfuture.org/blog-entry/2010051913/tax-cuts-rich-getting-back-economy-destroying-normal

No comments:

Post a Comment